Blog 14 - Profiting from Protection

- Jay Mason

- Jan 1, 2024

- 10 min read

___________________________________________

危机

"Within danger, there lie opportunities."

~ Confucius

___________________________________________

The Chinese symbol for "Crisis" fittingly describes how to approach portfolio protection. Like earthquakes, no one knows when the "big one" is coming. However, having already adopted the following portfolio management techniques outlined in Blog 13 should reduce the impact when it does:

Owning a well-diversified portfolio of quality assets (Tier 1)

Selling Covered Calls on core stocks (Tier 2)

Building up cash and debt reserves (Tier 3)

Setting Stop Loss and Trailing Stop Loss trade orders on core stocks (Tier 3)

The next step is to introduce several insurance techniques for those seeking to partially protect the remainder of their portfolio. After all, financial progress can also be measured by losing less than others when the "storm" arrives.

Hedging 101

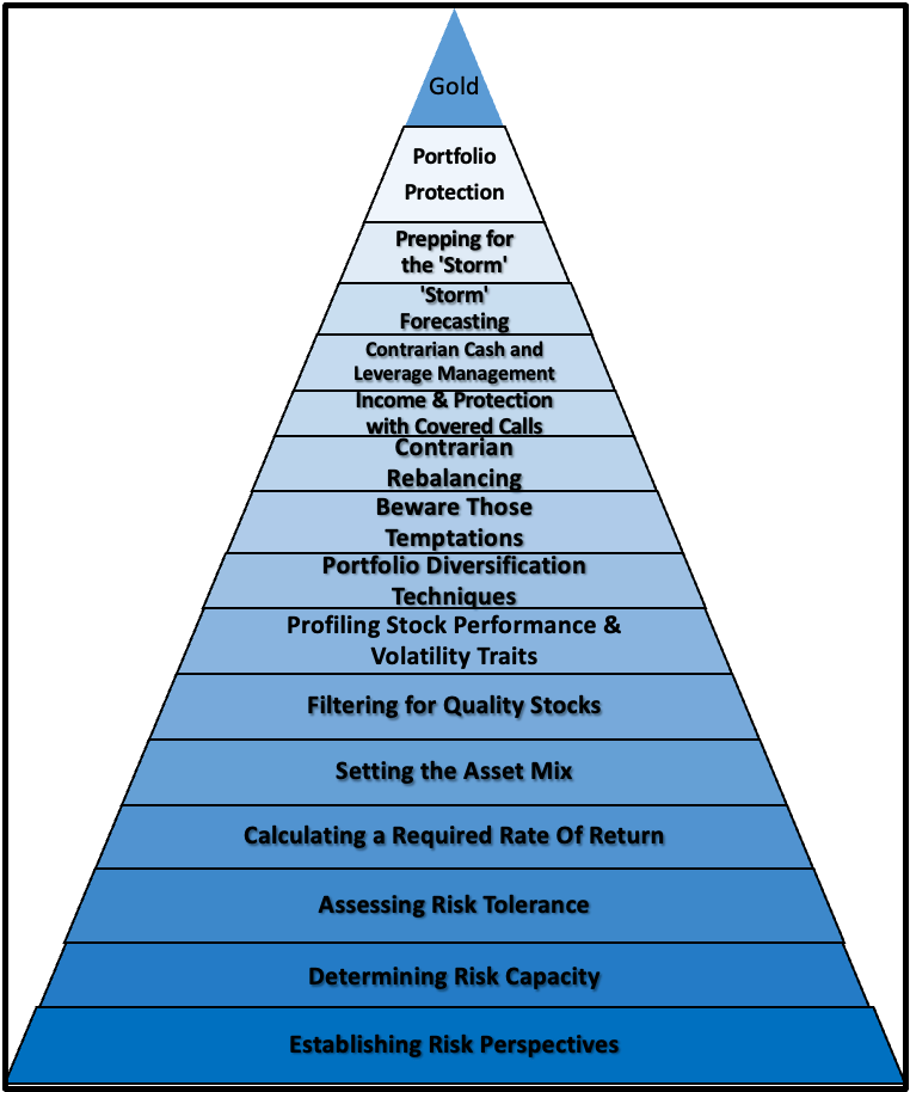

Portfolio insurance is the last line of defense in The Investing Oasis guide's comprehensive 16-Step Risk Management plan (Figure 3). Like all insurance products, a fee is paid to a third party to absorb a risk on a particular asset over a select period. Setting up effective protection allows a portfolio to diminish the impact of periodic corrections/bear markets.

Asymmetry

Ideally, the risk/reward profile of protection should be asymmetrical. This means the probability for profit should well exceed the cost of the insurance. As in home insurance, a homeowner pays a modest annual premium to gain substantial coverage. Equally, if a market pullback does not transpire, the insurance product will expire worthless. Such is the nature of insurance.

To keep a portfolio fully and constantly insured would be too costly, so discretion is required. Further, there are methods to reduce insurance costs.

Overall, since market corrections arrive with little warning, it pays to pre-plan. Just as leverage should only be seriously considered at the bottom of a market swoon, so should insurance be taken more seriously at the top of a market when stocks are hitting all-time highs.

Four Protection Decisions

Since portfolio insurance is discretionary, each investor will have different ideas about how much and when to apply it. When establishing a hedge, here are four primary issues to consider:

How much insurance?

When best to deploy the protection?

Ways to reduce insurance costs?

Which hedging tool?

How Much Insurance?

Since setting up protection is expensive, start by finding ways to reduce risk rather than attempt to eliminate it.

"An ounce of prevention is worth a pound of cure."— Ben Franklin(Franklin coined this phrase in 1736 to remind Philadelphia citizens to remain vigilant about fire awareness and prevention.)

Investors heeding Ben Franklin's proactive advice should already have their protection strategies in place (Blog 13). As the market sells off, pre-set defensive Trailing Stop Loss and Stop Loss orders likely would be triggered and Covered Calls should turn profitable. Up to 20-30% of the portfolio could now be liquid at the early stage of a market pullback (including existing cash).

For the remaining equity exposure, it's a personal decision how much coverage to apply. Trying to hedge all remaining equity would likely still be too costly.

Target: Keep the total annual cost of protection under 1% of a portfolio's total value. If your hedge turns profitable (the protection is working), then this 1% cost budget starts fresh.

Otherwise, the cost of unused insurance just reduces your toal performance

When Best to Deploy a Hedge

How good are you at predicting corrections? Since a significant market event happens on average every 20-24 months, the probability of a setback increases the longer the stock market advances without a substantive correction.

Example: The longest bull market in history (March 2009 to March 2020) ended with the fastest Bear Market in history (-33.8% in four weeks). However, if an investor had begun deploying portfolio insurance 24 months after the end of the Great Financial Crisis (March 2011), they would have spent a modest fortune waiting nine years for the next significant pullback (March 2020).

Deploying protection too soon can be as equally costly (wasted insurance) as deploying too late (expensive premiums). Three forecasting tools can help build awareness of when to begin establishing protection:

When all three align, it's likely time to consider hedging.

Being a Contrarian

The best time to deploy insurance is when markets are bumping along near record highs while volatility remains calm. However, protection may also be considered at any stage if an investor is otherwise vulnerable (high leverage, holding speculative securities, narrowly focused portfolio, low margin capacity).

Hedging Cost Reductions

There are already several real ways to reduce the costs of protection:

✓ Reduce equity exposure through more stringent, pre-set SL and TSL trade orders

✓ Hedge only a portion of the remaining equity exposure (15-25%). Less coverage, less cost.

✓ Introduce a deductible on the hedge. Similar to car insurance, by willing to pay the first $1,000 of minor collision damage, it saves on car insurance premiums. Since ordinary market volatility frequently ranges up to 15-30% each year, set the deductible to start coverage at around a 20% discount. This applies protection more against a potential Bear Market (beyond 20%) than protection against ordinary volatility. Examples provided further below.

✓ Subsidize protection costs by selling off higher unnecessary coverage. Historically, market selloffs eventually stabilize and then rebound to new record highs, never having ever come close to the Armageddon that we forecast. Examples provided further below.

Two Hedging Solutions

Figure 1 presents two solutions depending upon the outlook for volatility. In both cases, the assumption is that an investor desires to retain their portfolio relatively intact and deploy a hedge to diminish a market drawdown.

Figure 1: Temporary and Structured Insurance Solutions

Note: The following hedging solutions involve the use of options contracts. Investors should know how to trade options contracts or should seek professional guidance.

Short term Solution: Buy Protective At-The-Money SPY Puts

A protective SPY or SPX put will rise in value in response to a decline in the S&P 500. At modest cost, the rewards can be significant (asymmetric) but are time limited. Coverage could be bought and unwound repeatedly depending upon an investor's market outlook. At risk is the cost of the premium paid for the contract(s) if the market fails to sell off.

This would be a good product to experiment with to test your skills at setting hedges on short notice.

Hedging Formula

How many SPY Put contracts to buy to fully hedge a portfolio:

______________________________

Example 1: At-the-Money (ATM) Coverage

What would be the cost of hedging 20% of a $500,000 portfolio for 26 days?

Date: April 28, 2024

Current Portfolio: $500,000

Seeking Coverage until: May 24, 2024 (26 days)

Current SPY Value: $508

Calculation:

Coverage Sought: $100,000 (20% × $500,000)

$508 SPY Put contract: Premium = $6.50, Delta = 0.46

Total contracts: $100,000 ÷ ($508 × 0.46 × 100) = 5 contracts

Cost: 5 × $6.50 × 100 = $3,250

Introducing a Deductible (OTM Contracts)

The cost of hedging can be reduced by choosing to buy SPY Put contracts with a Strike Price below the current FMV (Out-of-the-Money). Coverage would not effectively begin until the SPY ETF valuation sank below the chosen Strike Price. However, the premiums paid per contract would be much lower.

Example 2: OTM Coverage with 10% Deductible

Same scenario, but Strike Price reduced by 10% (from $508 to $460):

Calculation:

$460 SPY Put contract: Premium = $0.44, Delta = 0.03

Total contracts: $100,000 ÷ ($460 × 0.03 × 100) = 73 contracts

Cost: 73 × $0.44 × 100 = $3,212

Example Comments

Even though costs are nearly identical, buying OTM SPY Put contracts enables the investor to purchase far more coverage (73 units vs. 5 shares), resulting in potentially greater payoff if the market sells off by more than 10%.

Since there could be 3-5 times per year when market upheaval may necessitate hedging, consider reducing the number of contracts to conserve your hedging budget.

Longer-term Solution: VIX Call Spread Collar ("Fence")

A laddered "Fence" provides enduring protection to be set incrementally on an ongoing basis. Best deployed during calm markets, and particularly near market tops, it has been the Oasis Growth Fund's most consistently successful portfolio protection method. Designed to seize on periodic spikes in unexpected volatility.

The VIX

The VIX is a well-known index revealing the state of fear in the general market. The highly volatile VIX makes for a favorable hedge due to its strong negative correlation with the S&P 500. According to data from the CBOE4, the VIX below 15 reflects relative market calm, and rarely falls below 10. A spike above 30 likely indicates a market correction, while VIX >40 potentially signals the onset of a Bear Market (Figure 2).

Figure 2: VIX Index vs S&P 500 Index

Building the Fence (Four Components)

a) Long VIX Call Contracts (Core Protection) - Buying VIX Calls is the core protection laddered across several months. The negative correlation of the VIX with the S&P 500 and the outsized reaction to volatility offer potent insurance. When the VIX is below 16, consider taking action.

Multiple Maturity Dates: Incrementally buy VIX Call contracts on positive market days up to 1-3 months ahead (Note: longer term reduces near-term hedging effectiveness)

Strike Price: Consider a Strike Price 20-25% above the current VIX price to only cover for major corrections. This would be the deductible.

b) First Cost Offset: Selling OTM Puts - To reduce the core cost of a hedge, simultaneously sell deep OTM VIX Put contracts maturing in the same month as the Long OTM VIX Calls. During turbulence, as the VIX rises, these Put premiums would decline. Historically, the VIX rarely falls under 10, therefore VIX contracts sold below 15 are highly likely to expire unexercised.

c) Second Cost Offset: Selling OTM Calls - To further reduce core hedging costs, simultaneously sell deeper OTM VIX Call contracts at a Strike Price of about $5 to $10 over the Long VIX Calls. This limits the potential hedging gains to be the net spread between the two Strike Prices. However, since the VIX rarely peaks above 30 (and even less frequently above 40), receiving premiums for the unlikely temporary event will provide further cost offset for laddered core hedges.

Note: The wider the spread between Long and Short VIX Calls, the greater the reward potential. However, higher Strike Prices garner lower premiums, reducing the overall insurance subsidy.

d) Laddering - Rather than invoking all protection in the front month, Fences can be laddered over several months and rolled over on their respective maturity dates if appropriate.

Free Protection?

While buying base protection is best done when the VIX is falling (markets rising), the best time to sell offsetting OTM VIX Calls is when the VIX is rising (markets falling). Premiums for these OTM VIX Calls will be rising. By delaying the sale of deeper OTM VIX Call contracts, you may receive high enough premiums to cover the cost of original protection.

The caveat: If volatility remains subdued up to maturity, there may never be a chance to sell higher VIX Calls. The insurance cost would remain unsubsidized by the second cost offset.

Realization of Gains

If volatility remains dormant, the nearest term portion may simply expire—this is the cost of insurance. However, when volatility spikes above the Strike Price of the short deeper OTM VIX Calls, the "Fence" will have reached its maximum gain and the entire position should be unwound. The maximum gain equals the spread difference between the long and short VIX Call Strike Prices less the net setup costs.

Reinstating Coverage

Once gains have been realized, consider waiting until the VIX calms again back below 18 before reinstating new hedge coverage. This could take several weeks.

VIX Fence: Pros and Cons

PROS

✓ VIX Contracts are highly liquid

✓ Can be set up gradually during periods of calm

✓ Can cover an extended period (1- 6 months)

✓ Offers strong negative correlation to the core portfolio of NA growth stocks

✓ The VIX response to fear usually exceeds the degree of stock market decline

✓ Asymmetric reward/risk profile—potential profits could far outweigh net cost

✓ Deploying both cost offsets improves overall cost-effectiveness of the core hedge

CONS

✗ Call contracts can expire worthless without adequate volatility

✗ Selling OTM VIX Calls to offset the core hedge premiums will cap the profit potential

✗ If VIX falls below OTM Put Strike Price at maturity, contract would be exercised, increasing overall cost

✗ When VIX rises above 20, absolute prices become more cost-prohibitive

✗ Don't attempt to buy VIX Calls during a market correction—contracts will be too expensive

Profiting from Volatility

As with any market timing tactic, success with portfolio insurance requires two sets of decisions:

Setup: Buying a hedge and selling two cost offset positions before the onset of volatility

Profiting: Selling the core hedge (VIX Calls) and buying back the two cost offsets during panic

Timing Clues:

Headline media will declare "Financial Armageddon"

Your hedges will have turned profitable

You will be in conflict—instincts will be to sustain these positionsl, rather than unwinding protection. This is the rare occasion when you must be willing to day trade.

Once hedge turns profitable, place a Trailing Stop Loss order to protect gains

"Killing Two Birds" with One Instinct

As hedges are unwound, it should also be the right time to begin deploying cash to average down on devalued core stocks and/or initiate positions in stocks on your watchlist. Both unwinding a hedge and DCA investing require the same gut instinct and courage. Inaction on either front will be opportunity lost.

By the time markets stabilize, most or all insurance position(s) should have been sold at profit. Equally, much of your cash should have been deployed into averaging down on core stocks. If the downturn exceeds 20%, possibly even some leverage might have been deployed.

Risk Management Planning

Having a plan may seem irrelevant when everything is going well. But just wait until it isn't. On average, "Mr. Market" likes to remind us about every 20-24 months.

By embracing the 16-Step OGF Risk Management Plan Figure 3, both your portfolio and you will be better prepared to handle market tumult. Each layer plays a progressive role in helping to protect your wealth. Success of the whole is requisite on confirming and mastering each step before tackling the next layer.

During times of turmoil, those who are better prepared stand to make the greatest relative gains.

Figure 3: Pyramid of Protection

"Winter is coming!" — Motto of the House of Stark, Game of Thrones

__________________________________

Resources:

The Investing Oasis - Chapter 27: "Hedging Techniques"

Footnotes:

Jay T. Mason, CFA, CFP manages the Oasis Growth Fund and is the author of

“The INVESTING OASIS: Contrarian Treasures in the Capital Markets Desert”,

as well as the blog series: ‘More Buck for Your Bang’.

______________________________

The Oasis Growth Fund is Series O of the Fieldhouse Pro Funds Inc trust series available by Offering Memorandum in Canada through select Financial Advisors. This education series is not intended as a solicitation for investment in the Oasis Growth Fund nor is it sponsored by Fieldhouse Capital Management Inc.

Comments